Two conservative think tanks filed a lawsuit against the Department of Education over its student debt forgiveness program, which seeks to “cancel” $39 billion in loan debt.

The lawsuit, filed by the New Civil Liberties Alliance (NCLA) on behalf of the Cato Institute and the Mackinac Center for Public Policy, claimed that the Department’s plan was “put on an accelerated schedule apparently designed to evade judicial review.”

The Department of Education announced the new plan last month, just weeks after the Supreme Court struck down the Department’s initial plan to cancel $430 billion in student loan debt under the pretense of a national emergency.

“Before the ink dried on the Supreme Court’s June 30 decision striking down a $430 billion student-loan cancellation program previously announced by the Defendant Department of Education (the “Department), the Department announced a host of equally unlawful loan cancellation schemes,” the lawsuit alleges.

The initial plan, announced by the White House last year, promised to cancel up to $10,000 in federal student loans for students who made less than $125,000 annually. On June 30, 2023, however, the Supreme Court ruled that the Department of Education and the Secretary of Education do not possess the authority to cancel student loan debt.

“The Secretary asserts that the HEROES Act grants him the authority to cancel $430 billion of student loan principal. It does not,” Chief Justice John Roberts wrote in the majority opinion. “We hold today that the Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, not to rewrite that statute from the ground up.”

The following month, the Department of Education announced its new plan to forgive $39 billion in student loan debt.

“In a press release announcing the loan forgiveness, the Department of Education stated that the White House ‘has approved more than $116.6 billion in student loan forgiveness for more than 3.4 million borrowers.'”

“Eligible borrowers are those whose federal loans are owned by the Department of Education, who are enrolled in income-driven repayment plans, and who have been paying back their loans for 20 or 25 years, depending on the nature of their loan.”

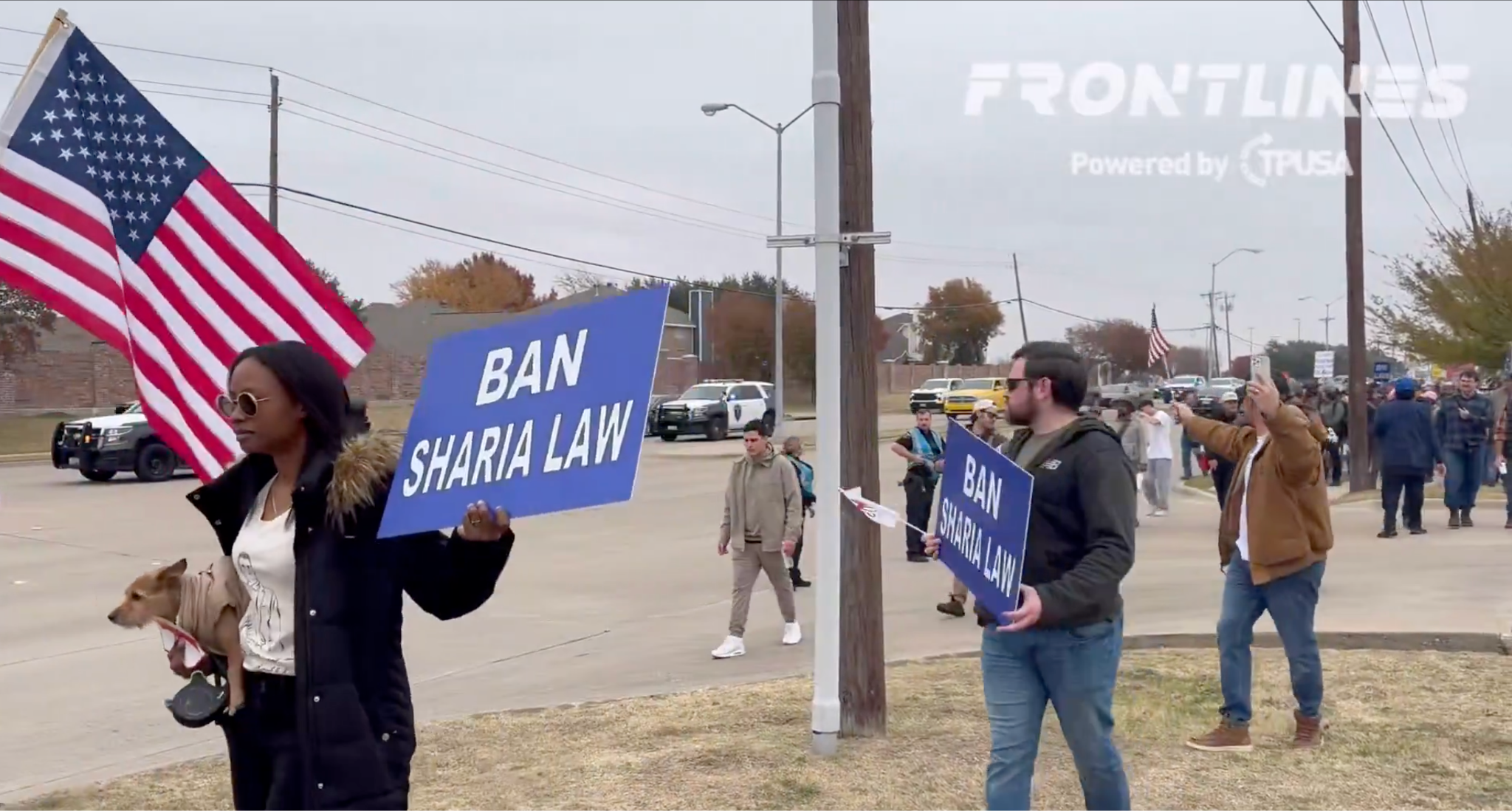

TPUSA Live Feed

The lawsuit filed by NCLA takes issue with the “so-called One-Time Account Adjustment,” by calling it an “illegal forbearance-credit scheme” and claiming that “No authority allows the Department to count non-payments as payments.”

“[The] scheme will outright cancel a massive amount of debt owed to the Treasury. By having their loans canceled three years early, 3.6 million borrowers will each make 36 fewer monthly payments, resulting in the cancellation of 130 million monthly payments. Thus, the $39 billion cancellation of debt for 804,000 borrowers that will occur in August 2023 is just the tip of the iceberg . . . Assuming the per-borrower cost of cancellation remains unchanged, the entire scheme will cost taxpayers $175 billion.”

Complaint: NCLA, Cato Institute and the Mackinac Center for Public Policy v U.S. Dept. of Education

The suit notes that currently, approximately 45 million borrowers’ outstanding federal student loan debt exceeds $1.6 trillion. Additionally, it notes “Congress has authorized several programs that allow Defendants to forgive the unpaid debt owed by certain student-loan borrowers who make qualifying monthly payments on those loans for a certain number of years. These include the PSLF [Public Service Loan Forgiveness] and IDR [Income-Drive Repayment] programs.” However, the plaintiffs are concerned that the Department’s attempt to alter the PSLF and IDR statutes is unlawful.